The complexities Indian entities and individuals face when expanding globally through Overseas Direct Investment (ODI). Governed by the Foreign Exchange Management Act (FEMA) and regulated by the Reserve Bank of India (RBI), ODI enables investments in foreign businesses via equity, loans, or guarantees. This SEO-friendly guide provides a comprehensive overview of ODI requirements, compliance reporting through the FIRMS Portal, and Tax Collected at Source (TCS) implications, updated for 2025. Whether you’re a corporate entity or an individual investor, this blog will help you navigate the regulatory landscape effectively.

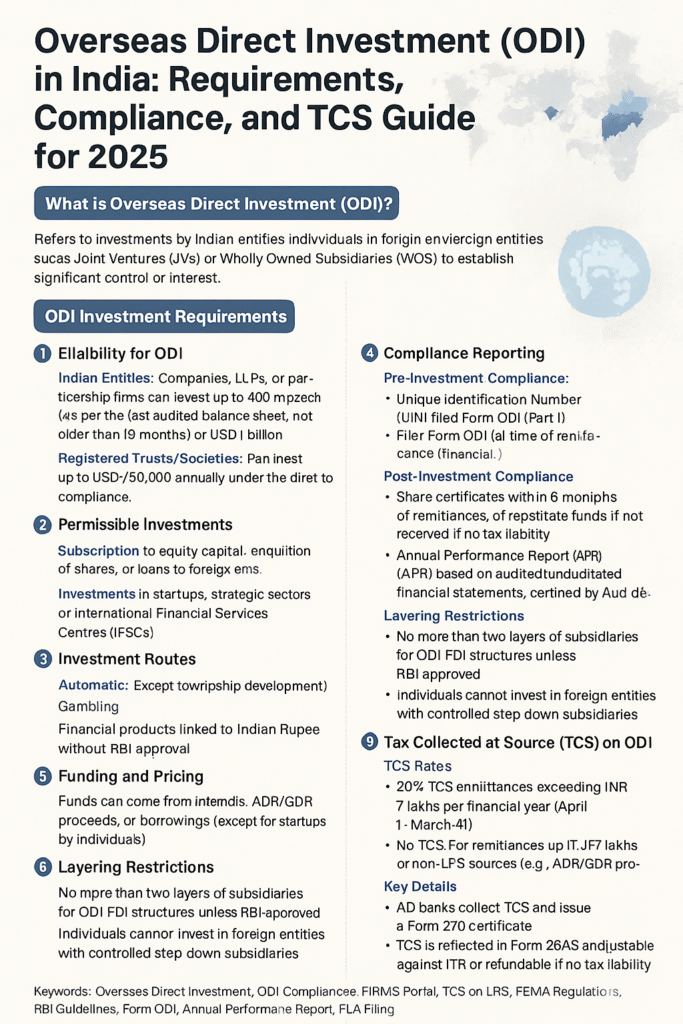

What is Overseas Direct Investment (ODI)?

ODI refers to investments by Indian entities or individuals in foreign entities, such as Joint Ventures (JVs) or Wholly Owned Subsidiaries (WOS), to establish significant control or interest. Governed by the Foreign Exchange Management (Overseas Investment) Rules, 2022, ODI is a strategic tool for global expansion, subject to strict FEMA compliance.

ODI Investment Requirements

To ensure a smooth ODI process, understanding the eligibility, limits, and restrictions is critical. Here’s a breakdown:

1. Eligibility for ODI

- Indian Entities: Companies, LLPs, or partnership firms can invest up to 400% of their net worth (as per the last audited balance sheet, not older than 18 months) or USD 1 billion per financial year, whichever is lower.

- Resident Individuals: Can invest up to USD 250,000 annually under the Liberalised Remittance Scheme (LRS) in operating foreign entities (not in financial services or with step-down subsidiaries where the individual has control).

- Registered Trusts/Societies: Permitted for charitable purposes with prior RBI approval.

2. Permissible Investments

- Subscription to equity capital, acquisition of shares, or loans to foreign entities.

- Investments in startups, strategic sectors (e.g., energy, natural resources), or International Financial Services Centres (IFSCs).

- Modes include share swaps, rights issues, or bonus shares, subject to compliance.

3. Investment Routes

- Automatic Route: No RBI approval needed if within net worth/LRS limits and FEMA guidelines.

- Approval Route: Required for investments exceeding limits, in sensitive countries (e.g., Pakistan, Nepal, FATF high-risk jurisdictions), or by entities under investigation (requires a No Objection Certificate).

4. Prohibited Sectors

- Real estate (except township development).

- Gambling.

- Financial products linked to the Indian Rupee without RBI approval.

5. Funding and Pricing

- Funds can come from internal accruals, ADR/GDR proceeds, or borrowings (except for startups by individuals).

- Investments must follow arm’s length pricing per internationally accepted methodologies, verified by Authorized Dealer (AD) banks.

6. Layering Restrictions

- No more than two layers of subsidiaries for ODI-FDI structures unless RBI-approved.

- Individuals cannot invest in foreign entities with controlled step-down subsidiaries.

Compliance Reporting for ODI

Compliance is the backbone of ODI, and the FIRMS Portal (https://firms.rbi.org.in) is the RBI’s centralized platform for reporting. Below are the key compliance requirements:

1. Pre-Investment Compliance

- Unique Identification Number (UIN): Obtain from the RBI via the AD bank before remittance.

- Form ODI (Part I): File within 30 days of investment, certified by a statutory auditor.

- Form FC: Submit at the time of remittance or financial commitment (e.g., loans, guarantees).

2. Post-Investment Compliance

- Share Certificates: Submit within six months of remittance, or repatriate funds if not received.

- Annual Performance Report (APR):

- File by December 31 annually (recommended by November 30) for each foreign entity.

- Based on audited/unaudited financial statements, certified by an Indian CA/CPA if auditing isn’t mandatory abroad.

- Annual Return on Foreign Liabilities and Assets (FLA):

- File by July 15 annually via the FLAIR Portal for entities with ODI or FDI.

- Repatriation: Dividends, sale proceeds, or liquidation funds must be repatriated within 90 days.

3. Using the FIRMS Portal

- Entity Master Form (EMF): Register the Indian entity first to obtain a user ID.

- Business User Registration: Authorize a representative to file forms.

- Single Master Form (SMF): Use for Form ODI, Form FC, and other filings.

- Upload documents like FIRC, KYC, and valuation reports, and track submission status.

4. Disinvestment and Restructuring

- Disinvestment allowed after one year, with proceeds repatriated within 60 days.

- Restructuring of loss-making entities requires certified valuation for significant diminutions.

- Investors under investigation need an NOC for disinvestment.

5. Penalties and Regularization

- Non-compliance (e.g., delayed filings, non-repatriation) attracts penalties under FEMA, up to three times the sum involved or INR 2 lakhs.

- Delays can be regularized within three years by paying a Late Submission Fee (LSF).

Tax Collected at Source (TCS) on ODI

TCS under Section 206C(1G) of the Income Tax Act applies to ODI remittances under LRS, impacting cash flow and tax planning.

1. TCS Rates

- 20% TCS: On remittances exceeding INR 7 lakhs per financial year (April 1–March 31).

- No TCS: For remittances up to INR 7 lakhs or non-LRS sources (e.g., ADR/GDR proceeds).

2. Key Details

- Collection: AD banks collect TCS and issue a Form 27D certificate.

- Credit/Refund: TCS is reflected in Form 26AS and adjustable against ITR or refundable if no tax liability.

- Exemptions: NRIs and non-LRS corporate remittances may be exempt.

3. Example

For a USD 100,000 remittance (INR 84 lakhs at INR 84/USD):

- INR 7 lakhs exempt.

- TCS = 20% of INR 77 lakhs = INR 15.4 lakhs.

- Total outflow = INR 84 lakhs + INR 15.4 lakhs = INR 99.4 lakhs.

Practical Tips for ODI Compliance

- Engage Experts: Consult a Company Secretary or FEMA expert for complex filings.

- Plan Remittances: Optimize the INR 7 lakh TCS exemption limit.

- Timely Reporting: Use the FIRMS Portal efficiently and file forms early to avoid LSF.

- Documentation: Maintain records of FIRC, valuation reports, and TCS certificates.

- Due Diligence: Verify foreign entities to mitigate risks and ensure compliance.