Mandatory Demat Requirement for Private Companies Extended Till June 30, 2025

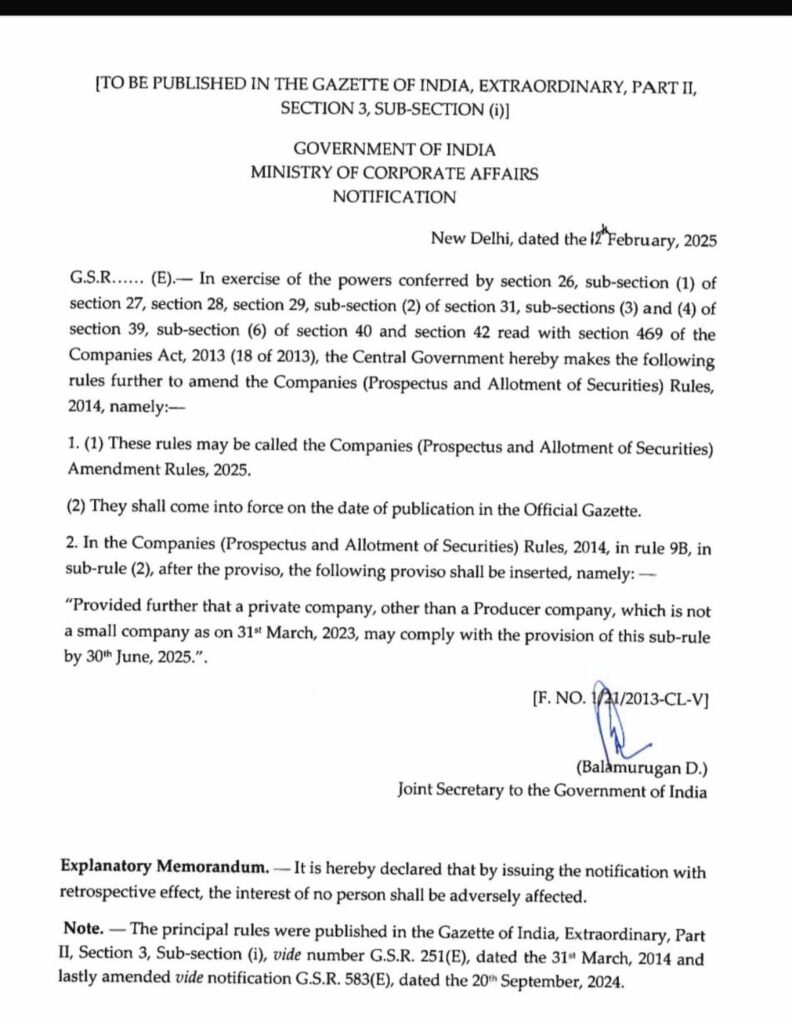

The Ministry of Corporate Affairs (MCA) has officially extended the deadline for mandatory dematerialization of securities for certain private companies. As per the latest notification dated February 12, 2025, the compliance deadline has now been pushed to June 30, 2025. This amendment modifies the Companies (Prospectus and Allotment of Securities) Rules, 2014, specifically rule 9B, which mandates dematerialization for certain classes of private companies.

Key Takeaways from the Notification

- The amendment extends the compliance deadline from the earlier set date to June 30, 2025.

- The extension applies to private companies (other than Producer companies) that are not classified as small companies as of March 31, 2023.

- The rule aims to ensure greater transparency, facilitate electronic transactions, and streamline securities management for private companies.

Implications for Private Companies

With this extension, eligible private companies now have additional time to ensure compliance with dematerialization norms. Here’s what companies need to do:

- Ensure that all securities are dematerialized before the new deadline.

- Coordinate with depositories (NSDL/CDSL) and registered transfer agents to facilitate the transition.

- Inform shareholders about the demat process and assist them in converting physical shares into electronic format.

Why This Extension Matters?

The dematerialization requirement aligns private companies with regulatory expectations applicable to listed entities, reducing risks associated with physical securities such as forgery and loss. However, many private companies had raised concerns about the tight timelines and operational challenges in shifting to the demat system. The latest extension provides much-needed relief, allowing businesses to implement the necessary changes without disruption.

Final Thoughts

The MCA’s move to extend the deadline acknowledges the practical difficulties faced by private companies in transitioning to dematerialization. Companies should utilize this extended period wisely and complete the process to avoid last-minute compliance challenges. With regulatory focus increasing on corporate governance and transparency, dematerialization remains a crucial step toward a more secure and efficient securities management system.