Step-by-Step Guide to Setting Up a Private Limited Company in India as a Foreign National

Setting up a Private Limited Company in India as a foreign national offers a structured and flexible way to enter the Indian market. A PLC allows 100% Foreign Direct Investment (FDI) under the automatic route in most sectors, making it a preferred choice for international entrepreneurs. This guide provides a detailed, step-by-step process to help foreign nationals establish a PLC in India as of June 2025, ensuring compliance with the Companies Act, 2013, and other regulations.

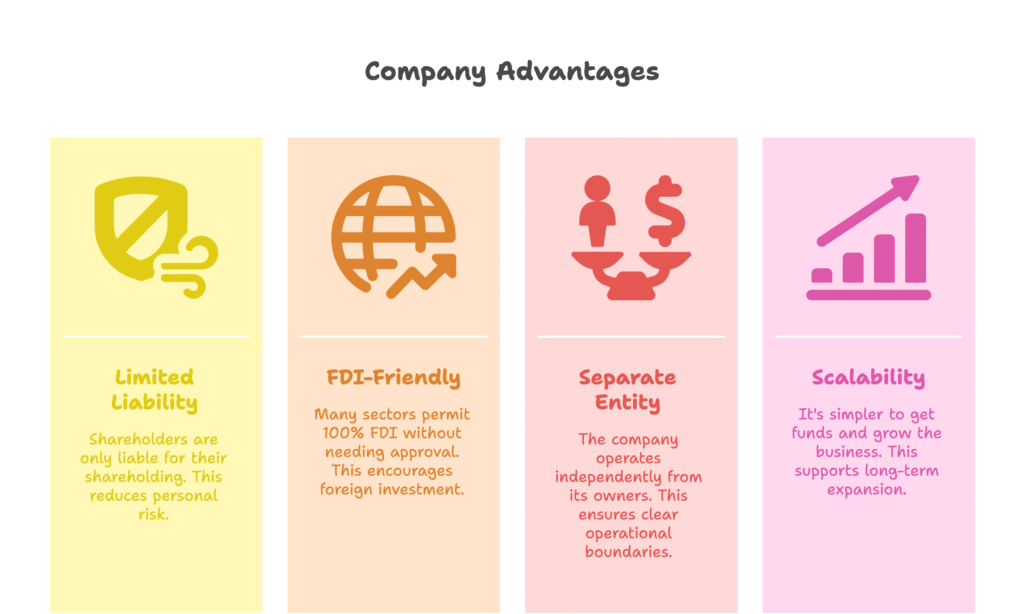

Why Choose a Private Limited Company?

- Limited Liability: Shareholders’ liability is limited to their shareholding.

- FDI-Friendly: Most sectors allow 100% FDI without prior approval.

- Separate Legal Entity: The company is distinct from its owners, ensuring operational independence.

- Scalability: Easier to raise capital and expand operations.

Step-by-Step Process to Set Up a PLC in India

Step 1: Understand Eligibility and Requirements

- Minimum Directors and Shareholders:

- At least two directors are required, one of whom must be a resident of India (residing in India for at least 182 days in the previous financial year).

- A minimum of two shareholders is required; shareholders can be individuals or entities, and foreign nationals/companies are eligible.

- Capital Requirement:

- No minimum capital is mandated, but a nominal amount (e.g., INR 1 lakh) is recommended to cover initial expenses.

- Registered Office:

- A physical address in India is mandatory for registration (a commercial or residential address can be used; proof of address is required).

Step 2: Obtain Digital Signature Certificate (DSC)

- A DSC is required to digitally sign incorporation documents.

- For Foreign Nationals:

- Apply for a DSC through a Certifying Authority (CA) in India, such as e-Mudhra or Sify.

- Required documents: Self-attested copies of passport, address proof (e.g., utility bill), and a photograph.

- These documents must be notarized in the foreign national’s home country and apostilled (if from a Hague Convention country) or legalized by the Indian Embassy (if from a non-Hague country).

- For Indian Resident Director:

- Apply using PAN card, Aadhaar, and address proof.

Step 3: Director Identification Number (DIN)

- Each director needs a DIN, a unique identifier issued by the Ministry of Corporate Affairs (MCA).

- Process:

- DIN can be applied for during the incorporation process via the SPICe+ form (Part B).

- Foreign nationals must submit apostilled/legalized passport copies and address proof.

- Indian directors provide PAN and Aadhaar details.

Step 4: Name Reservation

- Choose a unique name for the company, adhering to MCA naming guidelines:

- The name must reflect the company’s objective (e.g., “TechSolutions Pvt Ltd” for a tech company).

- It should not resemble an existing company/trademark or contain prohibited words (e.g., “Government,” “India” without approval).

- Process:

- File Part A of the SPICe+ form on the MCA portal (www.mca.gov.in) to reserve the name.

- Propose two name options in order of preference.

- Upon approval, the name is reserved for 20 days.

Step 5: Prepare Incorporation Documents

- Key Documents:

- Memorandum of Association (MoA): Outlines the company’s objectives, authorized capital, and shareholder details.

- Articles of Association (AoA): Defines the company’s internal rules and governance.

- Declaration by First Directors and Subscribers: A declaration of compliance with the Companies Act, 2013.

- Proof of Registered Office: Utility bill (not older than 2 months) and a No Objection Certificate (NOC) from the property owner.

- Identity and Address Proof: For foreign nationals, apostilled/legalized passport and address proof; for Indian directors, PAN and Aadhaar.

- Additional Requirements for Foreign Nationals:

- All foreign documents must be notarized and apostilled/legalized.

- A board resolution from the foreign entity (if a shareholder) approving investment in the Indian company.

Step 6: File the SPICe+ Form for Incorporation

- The SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) form is a single-window application for company incorporation.

- Components:

- Part A: Name reservation (already completed in Step 4).

- Part B: Incorporation details, including MoA, AoA, director details, and registered office address.

- Steps:

- Log in to the MCA portal and complete Part B of the SPICe+ form.

- Attach all required documents (e.g., MoA, AoA, identity proofs, address proof).

- Pay the applicable fees (based on authorized capital; e.g., INR 5,000 for INR 1 lakh capital, plus stamp duty).

- Upon submission, the form is processed by the MCA.

- Outcome:

- Upon approval, the MCA issues the Certificate of Incorporation (CoI), along with the company’s CIN (Company Identification Number), PAN, and TAN.

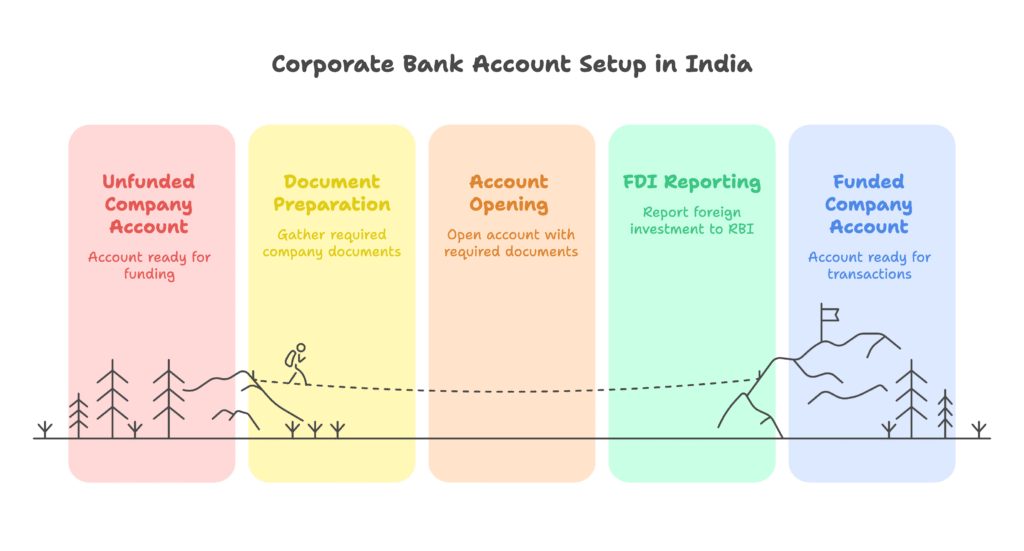

Step 7: Open a Bank Account and Deposit Share Capital

- Open a corporate bank account in India to deposit the share capital.

- Documents Required:

- Certificate of Incorporation, PAN, and TAN.

- MoA and AoA.

- Board resolution authorizing the account opening.

- Identity and address proof of directors.

- FDI Reporting:

- If share capital is contributed by a foreign national/entity, report the FDI to the Reserve Bank of India (RBI) within 30 days of allotment via the Foreign Inward Remittance Certificate (FIRC) and Form FC-GPR.

Step 8: Obtain Mandatory Registrations

- GST Registration:

- Mandatory if the company’s annual turnover exceeds INR 40 lakhs (INR 20 lakhs for certain states).

- Apply online via the GST portal (www.gst.gov.in) using the company’s PAN.

- EPF and ESIC Registration:

- Required if the company employs 20 or more employees (EPF) or 10 or more (ESIC).

- Register on the respective portals (www.epfindia.gov.in and www.esic.nic.in).

- Shops and Establishments Registration:

- Obtain this license from the state labor department within 30 days of commencing operations.

Step 9: Comply with Post-Incorporation Requirements

- Appoint an Auditor:

- Appoint a statutory auditor within 30 days of incorporation.

- File Form INC-20A:

- File a declaration of commencement of business within 180 days of incorporation, confirming that share capital has been received.

- Annual Compliances:

- File annual returns (Form MGT-7) and financial statements (Form AOC-4) with the MCA.

- Comply with FDI reporting (Form FLA) if applicable.

Key Considerations for Foreign Nationals

- Resident Director Requirement:

- Appointing a reliable Indian resident director is crucial. Consider hiring a professional director if needed.

- Apostille/Legalization:

- Ensure all foreign documents are properly apostilled (for Hague Convention countries) or legalized (for non-Hague countries) to avoid delays.

- FDI Compliance:

- Verify if the sector allows 100% FDI under the automatic route. Sectors like defense or media may require government approval.

- Professional Assistance:

- Engage a local Company Secretary (CS) or Chartered Accountant (CA) to navigate the process smoothly.

Timeline

- Timeline:

- Name reservation: 2-3 days.

- DSC and DIN: 2-5 days.

- Incorporation (SPICe+ processing): 7-10 days.

- Total: Approximately 15-20 days, assuming no delays.

Conclusion

Setting up a Private Limited Company in India as a foreign national is a straightforward process if you follow the steps outlined above and ensure compliance with Indian laws. From obtaining a DSC to filing the SPICe+ form and meeting post-incorporation requirements, each step is critical to establishing a successful business presence in India. For a hassle-free experience, consider partnering with local experts to handle regulatory nuances. Start your Indian business journey with confidence and tap into one of the world’s fastest-growing markets!